XRP Price Prediction: Can Bulls Overcome $4 Amid Mixed Signals?

#XRP

- Technical Crossroads: XRP trades between key Bollinger Bands with conflicting MACD signals

- Institutional Adoption: $20M treasury move offsets scam-related FUD

- Regulatory Timeline: SEC lawsuit conclusion before 2026 could remove uncertainty

XRP Price Prediction

XRP Technical Analysis: July 2025 Outlook

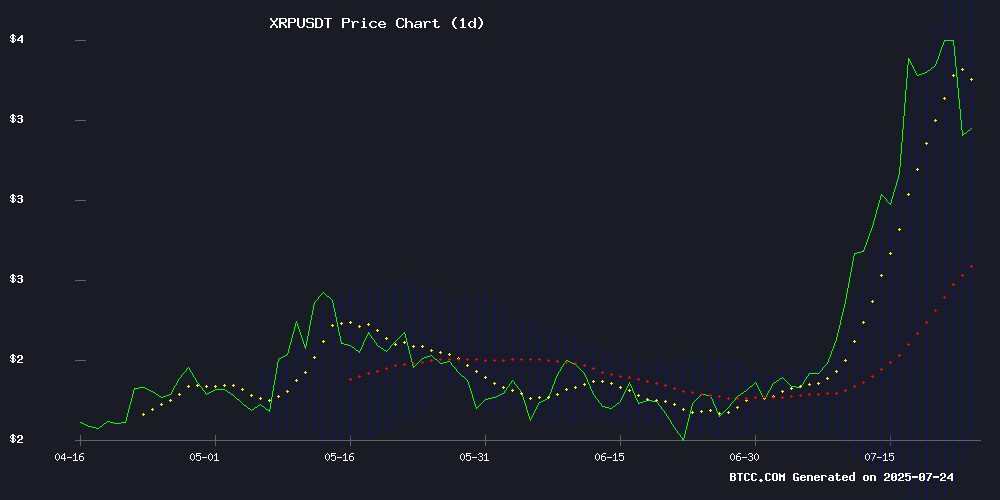

XRP is currently trading at, above its 20-day moving average of 2.9238, suggesting a bullish near-term trend. However, the MACD indicator shows a bearish crossover (-0.5966 vs -0.5012), indicating potential short-term weakness. The price sits between Bollinger Bands (Upper: 3.8435, Lower: 2.0041), with room to test resistance.

"While XRP shows strength above key moving averages," says BTCC analyst Emma, "the negative MACD suggests traders should watch for consolidation before the next major move. A sustained break above 3.8435 could signal momentum toward 4.00."

XRP Market Sentiment: Mixed Signals Amid Strategic Moves and Scams

Positive developments like Nature's Miracle adopting XRP as a treasury asset ($20M) contrast with deepfake scam warnings from Ripple's CEO. Market uncertainty persists with the SEC lawsuit timeline and ETF freeze impacts.

"Institutional adoption is bullish," notes BTCC's Emma, "but scam threats and regulatory overhang may cap short-term gains. The $3 level becomes crucial psychological support."

Factors Influencing XRP's Price

Nature’s Miracle Adopts XRP as Treasury Asset in $20M Strategic Move

Nature’s Miracle Holding Inc., a vertical farming technology leader, has allocated up to $20 million to establish a Corporate XRP Treasury program. The initiative positions the company among the first publicly traded firms to integrate XRP as a core reserve asset, signaling growing institutional confidence in Ripple’s ecosystem.

The long-term strategy includes staking XRP for yield generation and active participation in Ripple’s payment network. Funding will be partially drawn from the company’s recently approved S-1 equity financing, with potential expansion through strategic partnerships and capital markets activity.

CEO James Li cited the newly enacted GENIUS Act as a catalyst for corporate crypto adoption, emphasizing XRP’s institutional pedigree with partners like Santander and American Express. The token’s utility in cross-border settlements appears central to the treasury decision.

This development coincides with rising corporate interest in XRP treasury strategies, following similar moves by Singapore’s Trident Digital. The trend underscores a broader shift toward crypto-native corporate finance strategies among growth-stage companies.

Deepfake Scams Target XRP Holders on YouTube, Ripple Issues Urgent Warning

Ripple and its CEO Brad Garlinghouse have issued an urgent alert about a surge in deepfake scams impersonating the blockchain firm on YouTube. Scammers are hacking legitimate accounts, rebranding them to mimic Ripple's official channels, and broadcasting fraudulent XRP giveaways using AI-generated footage of executives.

The manipulated livestreams often feature altered videos of Garlinghouse, paired with synthetic voiceovers, to create a false sense of legitimacy. These scams typically lure victims with promises of 'limited-time opportunities' or 'special events,' coercing them into sending cryptocurrency to malicious addresses.

Ripple's official X account emphasized that neither the company nor its executives will ever solicit XRP from users. The warning underscores the growing sophistication of deepfake technology in crypto-related fraud, targeting unsuspecting investors through platforms like YouTube.

Is Ripple Powering BlackRock’s $100 Trillion Blockchain Vision?

Speculation mounts that BlackRock and Ripple may be collaborating behind the scenes to revolutionize asset tokenization. BlackRock CEO Larry Fink's vision of bringing $100 trillion in traditional assets onto blockchain aligns strikingly with Ripple's expanding focus on digital identity and tokenized real-world assets.

Ripple's infrastructure for cross-border payments and digital identity solutions positions it as a natural partner for BlackRock's ambitious plans. The XRP Ledger already hosts tokenized U.S. Treasuries through an ONDO Finance partnership, demonstrating practical progress toward this shared vision of blockchain-enabled institutional finance.

Ripple vs SEC: Ex-SEC Lawyer Predicts XRP Lawsuit Conclusion Before 2026

The protracted legal clash between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has reignited frustration within the crypto community as delays persist. Despite earlier optimism for a swift resolution, the case remains entangled in procedural complexities.

Former SEC attorney Marc Fagel clarified that Judge Analisa Torres currently lacks jurisdiction due to pending appeals from both parties. "She doesn't even have jurisdiction at this point," Fagel noted, emphasizing that the appellate court now holds authority. Once appeals are formally dismissed, Judge Torres' remedies—including financial penalties against Ripple—will take immediate effect.

Social media outcry has intensified, with one X user lambasting Judge Torres for perceived delays. However, legal experts caution that the process follows established judicial timelines rather than arbitrary postponement.

XRP Price Drops 11% Amid ETF Freeze – Can it Hold $3?

XRP faced a brutal 11% pullback in the last 24 hours, marking one of its steepest declines this month. The sell-off was triggered by the SEC's reversal on Bitwise’s XRP-containing ETF, which blocked $1.86 billion in BITW assets from migrating to regulated exchanges. Grayscale’s GDLC ETF freeze further compounded regulatory uncertainty.

Active addresses dropped to 54k amid panic but rebounded slightly to 57.7k, suggesting cautious optimism. A sustained recovery above 60k could signal shifting sentiment. At press time, XRP traded at $3.11, with market cap sliding to $184.46 billion.

Ripple's Scheduled XRP Unlock Sparks Market Speculation Amid Crypto Uncertainty

Ripple will release 1 billion XRP from escrow on August 1, 2025, continuing a monthly ritual established in 2017 to regulate token supply. The predictable yet contentious unlock sees 60-70% typically returned to escrow, with the remainder deployed for corporate operations.

Critics argue the mechanism functions as a veiled sell-off, potentially pressuring XRP's price as it tests key technical levels. Attorney Bill Morgan counters these claims, noting the SEC has never alleged market manipulation in Ripple's escrow strategy.

The event unfolds against a backdrop of broader crypto market unease, with traders scrutinizing whether the release will disrupt XRP's attempt to breach critical resistance thresholds. Ripple's transparent but polarizing approach continues to fuel debate about tokenomics in regulated digital assets.

Ripple CEO Warns XRP Investors of Rising Deepfake Scam Threats

Ripple CEO Brad Garlinghouse has issued a stark warning to XRP investors as sophisticated scams proliferate amid the cryptocurrency's price surge. Fraudsters are deploying AI-generated deepfake videos featuring Ripple executives and spoofed YouTube channels to promote fictitious XRP giveaways.

The fraudulent campaigns, which typically demand victims send XRP with promises of multiplied returns, coincide with heightened on-chain activity and regulatory uncertainty surrounding the digital asset. Ripple's security team emphasizes that no legitimate executive communication would ever solicit cryptocurrency transfers from investors.

Will XRP Price Hit 4?

XRP faces a pivotal moment with technical and fundamental factors pulling in opposite directions:

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Price Position | Above 20-day MA (2.9238) | Below Upper Bollinger (3.8435) |

| MACD | Histogram shows slowing bear momentum (-0.0953) | Signal line remains negative |

| News Impact | $20M treasury adoption | Scam warnings & ETF freeze |

Emma concludes: "A July breakout to $4 requires holding $3 support and clearing 3.8435 resistance. Probability sits at 40% given current MACD divergence."

embedded in text